Avoiding probate court: How creating a trust can save your beneficiaries both time and money

There are a variety of types of trusts. In this article, however, ‘trust’ refers to a revocable, living trust, or a family trust, that enables an estate to bypass probate. A trust can be created during a person’s lifetime. Or a trust can be established at death, as directed in a person’s will. Trusts are one way the rich stay rich by helping families maintain wealth across generations.

There’s much to know about trusts but key is that they’re designed to protect an estate from paying large legal fees and taxes to wrap up a person’s financial affairs after death. Here’s the crux: if a person owns assets whose net worth exceeds $150,000 in California, is concerned with preserving the value of those assets upon death, and wants to spare beneficiaries a long and expensive process known as probate court, it makes sense to consider creating a revocable trust.

A trust holds property

According to Legal-Dictionary, a ‘trust’ is a relationship created in order to hold, protect and use one or more person’s property for the benefit of others, subject to certain duties. When property is transferred to a trust, ownership of that property is transferred as well. People designated as ‘trustees’ control the trust. Because it’s revocable, however, the trust can be changed or even terminated during a person’s lifetime.

Probate court: avoidable

In most cases, assets held in trust bypass probate – the infamous specialty court that handles the distribution of assets, income and debts following a person’s death. When assets aren’t held in a trust, however, probate court often determines an estate’s ultimate disposition. Unfortunately, fees associated with probate court often can be substantial and take a large bite out of an estate’s value. Finally, the process can take two years to resolve – or longer! For these reasons, it is to be avoided.

The cost of probate in California

How much does an average-value estate pay in probate costs in California? Consider the following.

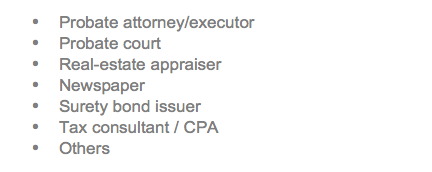

Who gets paid

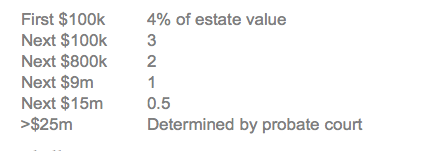

Attorney/executor fees1

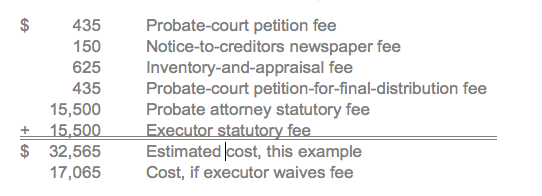

A $625k illustration1

Here’s how fees and costs might add up for a routine probate case in California that has an estate value of $625,000.

Finally, if the case triggers a taxable event, taxes may be owed, too.

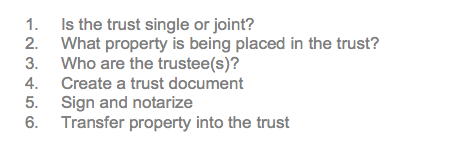

How to a create trust: 6 steps

Learn more about trusts

Questions about living trusts, probate court, or preserving the value of estate assets? Visit www.courts.ca.gov/8865.htm, or contact an estate-planning attorney. If you don’t have one, we can help you find one; contact Ryan or Kitty at contact@courtinvestmentservices.com, (800) 880-2760.

1 www.probateandtrustlawyers.com/probate/probate-costs, 3 May 2019.

Court Investment Services (“CIS”) is a dba of SilverOak Investments, LLC, a registered investment adviser with the Securities and Exchange Commission. Such registration does not imply a certain level of skill or training. CIS may only transact business or render personalized investment advice in those states and international jurisdictions where the firm is registered/filed notice or otherwise excluded or exempted from registration requirements. Any communications with prospective clients residing in states or international jurisdictions where CIS is not registered or licensed shall be limited so as not to trigger registration or licensing requirements. Additional information regarding CIS, its services, compensation, and conflicts of interest is contained in the firm’s Form ADV Part 2 and is available upon request or at www.adviserinfo.sec.gov.

The information herein has been provided for information purposes only and is not intended to provide investment advice to any single investor or group of investors and no investor should rely upon or make any investment decisions based solely upon its contents. Some of the information contained herein has been obtained or is derived from sources prepared by unaffiliated and independent third parties not associated with CIS. While CIS believes the information to be reliable for the purposes used herein, CIS has not independently investigated or verified the accuracy of this information, and does not assume any responsibility for, nor guarantee, the accuracy, adequacy or completeness of any such information.

CIS does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional.

Copyright 2019. All rights reserved. No part of this publication may be reprinted without the express prior permission of Court Investment Services.